Monday, April 26, 2010

In this video The Real News Network correspondent Paul Jay interviews Robert Pollin, founding codirector of the Political Economy Research Institute at UMass Amherst, inquiring about the most efficient avenues that the Obama administration can take in creating jobs and strengthening the economy.

The video, titled Is War the Answer to Depression?, explores the efficiency of job creation in different markets in the United States compared to military spending. Pollin's studies have found that there are many other legitimate means of job creation, which operate more efficiently and effectively than the military. Pollin says "Using the input-output model from the Department of Commerce, what we basically find is as follows, that if you spend $1 million on the military, you create 12 jobs; if you spend $1 million on clean energy, you create 17 jobs; if you spend $1 million on health care, you create 20 jobs; if you spend $1 million on education, you create 29 jobs," making it clear that diversifying our investments in the job market would be wholly beneficial.

Pollin goes on to explain exactly why military spending is so much less effective than other industries. He notes that sending soldiers overseas ends up transferring taxpayer money into international economies more than our own. Pollin urges the government to bring jobs back from overseas to the homefront, stating that "obviously, military spending has a high proportion of spending abroad, and that's not going to create jobs in the US. These other areas that I mentioned—education, health care, clean energy—are much more focused on the domestic economy." If Pollins suggestions are realized, we could be looking at a much more sustainable, efficient, and morally sound economy.

Tuesday, April 20, 2010

Saturday, April 17, 2010

California Jobless rate hits new high; Unemployment Benefits Run Dry

Unfortunately, the Los Angeles Times' reports many Californian's, jobless benefits are expiring. It is estimated that as many as 100,000 unemployed Californians could loose their jobless benefits by mid-April.

Some economists blame California's job woes on the jobless benefits themselves, saying that they discourage people from seeking jobs, but this is very unlikely. Despite the recent passage of the Federal Jobless Bill, around 843,000 Californian's have been unemployed for at least 27 weeks. For every one job opening, there averages around 5.5 applicants, creating a very inhospitable job market.

With California's jobless rate hitting 12.6%, all levels of government are hard-pressed, while at the same time cash-strapped, to solve the recession's problems. In order to solve the unemployment problems, the government must pass solutions which precisely create jobs in order to stimulate the economy in the long term, as well as limit costs for the government, which could potentially be pushed onto the taxpayers and small businesses.

Good Website to Follow the Job Market (Diffrences Between States)

The website, odinjobs.com, presents a map of the United States on the left side of the homepage, examining the health of the job market in each state. States shaded in red have the highest demand for jobs while states in green have the lowest demand. Surprisingly, despite an 12.6% unemployment rate, California has an extremely high demand for jobs. Overall, California, Texas, Pennsylvania and New York have the most demand for jobs in the U.S. Wyoming, North and South Dakota, Montana, Idaho, West Virginia and Mississippi are lagging in relative demand. The map also presents data for median salaries. Once again, California and New York lead the nation, with the highest median salaries. The dynamics of the job market within individual states is an topic for further exploration. Some states are suffering from incredibly high unemployment rates while others are weathering the recession, not suffering from the same losses. This website is helpful in examining the differences in the job market between states.

Here is an article from NY Times which looks at statistics regarding the job market in individual states from March. It notes that 33 states showed job growth in March, with strongest growth coming from Maryland. States like California, Michigan and Georgia continued to hemorrhage jobs - evidence that the recession may be deepening in those states. Interestingly, North Dakota has the lowest unemployment at 4%. Once again, this article shows how the dynamics of job markets in individual states vary greatly.

Here is a video from New Mexico, highlighting the job market in New Mexico:

We will be sure to keep an eye on states individual unemployment rates as they will have political consequences in the 2010 and 2012 elections. Incumbents in states which continue to loose jobs may be punished by voters while the economy may be an non issue in states which continue to add jobs.

Tuesday, April 13, 2010

Friday, April 9, 2010

33 States SOL for Unemployment Benefits

Money for jobless benefits are created when the government collects a small tax from employers on their employee's wages. CNN reporter Hibah Yousuf stated yesterday that "while total wages and weekly jobless benefit levels have been rising, governments haven't increased the taxable base wages at the same pace." This presents a bittersweet conclusion: unemployment benefits are rising (good); we don't have the money to pay for them (bad).

Yousuf writes that the government has caused this lack of money for benefits by using a "pay as you go" strategy. During strong economic times, the feds keep taxes and funds at a low level; during weak times (like right now), the government raises taxes and slashes benefits. It is no surprise that the mere 13 states who do have sufficient unemployment-designated funds did not use this strategy.

Andrew Stettner, deputy director of the National Employment Law Project, makes the obvious and necessary conclusion: "As the broke funds of 33 states makes clear, unemployment insurance reserves need to be stocked up before recessions hit so that states are prepared."

Stay positive, nation.

Friday, April 2, 2010

Interview with Economics Professor Sita Slavov

cutting the payroll tax for *all* workers is a good fiscal stimulus

policy. It encourages firms to hire and, compared to other kinds of

tax cuts, puts more money in the pockets of low-income individuals.

It's certainly better than large amounts of federal spending without

careful cost-benefit analysis (like a lot of the ARRA spending). But

I question the value of additional stimulus at this point. The

economy has started to recover, so to a certain extent, the credit

will go to firms who would have hired people anyway. That is wasted

money. Also, the HIRE act doesn't cut payroll taxes for everyone --

only for workers who have been unemployed for two months -- and this

can create problems. Ideally, an employer should hire the best

candidate for a job. Tax considerations should not influence this

decision. But the best candidate for a job may not be someone who has

been unemployed for 2 months. So, a firm may hire someone who is not

as productive just to take advangate of the credit.

What would you propose, if you were a legislator, to boost the job market?

to work and focus on policies that strengthen the job market in the

long run. Taxes on income discourage work, and highly progressive

taxes discourage education (because the resulting higher incomes are

taxed more heavily). Federal taxes are highly progressive -- the top

20% of households pay more than two thirds of all federal taxes

combined. Taxes should be made lower and flatter. Lowering the tax

burden on investment can also increase investment and boost

productivity and wages.

same goes for business owners. The government is facing serious

long-run budget problems. Still, we want the government to fix the

economy, subsidize our car and home purchases, pay for our health

care, make us feel safe -- and not raise our taxes. But the reality

is that if we want all these "goodies" from the government, we have to

be willing to pay for them -- we can't just shift the entire bill onto

the few people who make more than $250,000 a year. Larger welfare

states and safety nets in Europe are paid for by higher taxes on

everyone, not just the super rich. We need to do a better job of

recognizing this basic tradeoff and stop expecting the government to

give us everything want.

Is there any way to increase job security so that this spike in unemployment would happen again?

will experience high unemployment again. There is very little the

President or Congress can do to prevent recessions. The goal for

policymakers should be to try to manage business cycles as well as

possible. They can try to reduce the severity of recessions through

monetary and fiscal policy, and provide a safety net (e.g.,

unemployment insurance) for those who are hit the hardest. Also, a

well-functioning labor market with minimal regulation can adjust more

quickly to changing conditions.

Job Market Improves in March

Here is an interesting exchange between two Congressman on CNBC regarding how these numbers will be played politically:

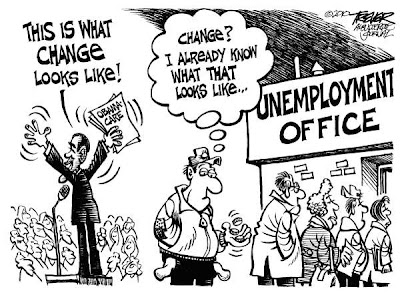

In the end, this news will be beneficial for President Obama and his approval ratings. According to Real Clear Politics, President Obama's average approval rating is 47.8%. By and large, Obama's approval ratings weren't drastically changed by the passage of Health Insurance Reform. This suggests that the American public is still waiting to see major economic gains. Ultimately, positive approval ratings have historically been correlated with a strong economy, so any good news on this front is bound to help President Obama.

Additionally, here is an interesting Harris Interactive Poll. According to the poll, two thirds of all Americans believe that creating jobs now is more important then controlling the deficit. Also, 49% of of Americans believe that more government spending increases job growth, while only 22% believe the opposite.

The results of this poll suggest that the government should be focusing, now, on taking whatever measures are necessary to promote job growth. While there is still some scholarly debate regarding whether or not massive government spending is the answer (See Robbie Moore Interview vs. Robert Polin's 18 Million Jobs piece), at least the government knows that most Americans want jobs right now.

Monday, March 29, 2010

The HIRE Act is Here

With the coming eclipse of the behemoth legislative process that was health care reform, Congress was able to focus on the nation’s top public and domestic security concern: job creation.

Today (March 18th, 2010) at 11:27 am President Obama signed a much-anticipated jobs bill into law, hoping its measures will reduce the unemployment rate that has so plagued American confidence and livelihoods since the 2008 economic crisis. The President highlights the bill as an achievement for both business owners and those seeking jobs. Entitled The HIRE Act, the bill’s four core components include:

Tax breaks to reduce expenses for businesses: “payroll taxes will be forgiven for businesses that hire someone who has been unemployed for at least two months.”

- Business incentives to promote growth and thus increased employment opportunities: the law allows “small businesses to write off investments they make in equipment this year.”

- Stimulating new job sectors: “It will reform municipal bonds to expand investment in schools and clean energy.”

- Public works and infrastructure programs: “it will continue roadway infrastructure investment into the spring and summer, when, the president said, construction jobs pick up.”

Originally a $150 billion proposal, the package was reduced to $17.5 billion to secure enough votes for its passage in today’s budget-wary public and political environment. Democrats say it is the first of a series of bills to promote job growth.

“A consensus is forming that, partly because of the necessary -- and often unpopular -- measures we took over the past year, our economy is now growing again and we may soon be adding jobs instead of losing them. The jobs bill I'm signing today is intended to help accelerate that process,” says Obama.

In his introduction of the bill Obama states that, by economists’ understanding of the stages of economic recovery, the United States is slowly moving forward. This is measured by such factors as whether an economy is growing, whether businesses have begun to hire temporary workers or increase employee hours, and whether businesses have begun to hire full-time employees again. However, he admits that for the hard-hit middle class on the local level, economic good times seem a long way off.

“I'm signing it mindful that, as I've said before, the solution to our economic problems will not come from government alone…But what we can do is promote a strong, dynamic private sector -- the true engine of job creation in our economy.”

Obama lauded all the members of Congress for passing the bill and stated that he was thankful that “over a dozen Republicans agreed that the need for this jobs bill was urgent, and that they were willing to break out of the partisan morass to help us take this forward step for the American people.” Emphasizing that economic recovery is “about all Americans” regardless of party and ideology, the President said he hoped this bill was a sign of more cooperation to come.

While optimistic about the future, the President did issue a disclaimer. “Now, make no mistake: While this jobs bill is absolutely necessary, it's by no means enough. There's a lot more that we're going to need to do,” he said, suggesting that helping small businesses to get loans and offering incentives to make buildings more energy efficient are among other needed changes.

There are, of course, those skeptical of the act’s potential. Some estimates say the tax break will create approximately 250,000 jobs by the end of 2010, but critics urge this is a trivial number given the 8.4 million jobs that have been lost in the recession.

I personally fear that, though $17.5 billion sounds like a significant amount of money, the bill falls far short of the tipping-point necessary to turn the job market around. Sadly, if this is the case, these billions will have been spent for little gain. I understand the political inertia around passing fiscally large, comprehensive bills—especially now when fear of big-government and national spending is so rampant—but I believe oftentimes this restraint comes at the cost of legislation being effective (and then what’s the point?).

Stay tuned for more information on the effects of this legislation as it becomes available, and for more expert opinions on how--and whether--government can create measures for a better job market.

All numerical information in this post is from CBS (http://www.cbsnews.com/8301-503544_162-20000700-503544.html).

Saturday, March 27, 2010

Tuesday, March 23, 2010

A Discussion with Economics Professor Robby Moore

Today we sat down with Professor Moore to discuss the job market and the impact of the HIRE Act, the American Recovery and Reinvestment Act and the passage of Health Insurance Reform.

Q: Do you believe that the the stimulus bill was effective in saving jobs in the American economy?

RM: No, the bill was not focused enough to have any real impact. The stimulus should have been focused solely on job creation. I think it has had some minimal effect, but I think it was horribly designed. Any stimulus should be very targeted, very short term, and focused towards sectors that are hemorrhaging jobs. The better approach would have been a smaller stimulus that would have utilized tax cuts more effectively. Fixing the financial freeze on Wall Street was more important to the job market then the measures adopted by the stimulus.

Q: The CBO noted that the stimulus package has saved roughly two million jobs in the fourth quarter of 2009, what are your thoughts on this?

RM: Most economists look at net jobs created rather then this mythical figure of jobs saved. Jobs saved does not account for jobs lost in other sectors.

Q: What impact do you think the passage of comprehensive Health Care reform will have on the labor market?

RM: The passage of Health Care will most likely increase unemployment. This is a bill of trade-offs. While it increases accessibility, which could considered a good thing, it will create uncertainty for small businesses. Obama has tried to radically change the economy which will have and adverse effect on small businesses.

Q: Where do you think the job market is headed in the next 5-10 years?

RM: Well, for economists that a long time. Because of all of this uncertainty I don't see the unemployment rate lowering that much for a while. Most economists are saying it will take quite a long time. The main determiner of that is if we become a regulated economy. The way Obama is going we are looking more like Europe. Unemployment in France, Germany, and England over the past ten years has been much worse compared to here in the United States - and we are moving in that direction.

Q: Do you think the administration should be focusing solely on job creation? If so, what measures would you recommend?

RM: I believe in less regulation of the labor market. I also believe in eliminating the minimum wage for young workers. There are currently high rates of teen unemployment mostly due to the minimum wage. There is no easy fix, long term growth needs to be fostered in order to increase employment - its a tough to accomplish. If you can target the spending, like on infrastructure, that might be somewhat effective. Defensive spending might also be effective in creating new jobs, but this is unlikely to happen.

Q: Do you see the potential for job creation in the green energy sector?

RM: If it is in a sector that is not already filled to capacity, so one in which there is more room for growth, then its okay. However, it is still such a small share of the economy. Maybe 30 years from now it will be a big enough share to have a real impact. Right now the green energy sector represents less then 1% of our GDP.

Q: Any final thoughts?

RM: The government needs stop creating uncertainty within the job market. Tax cuts, as seen under Reagen and Bush would be helpful for small business growth. We must foster long term growth through less government regulations and restrictions.

Thursday, March 18, 2010

American Recovery and Reinvestment Act... Did it Work?

However, estimates released by the Congressional Budget Office have assessed that the stimulus bill saved anywhere from 1-2 million jobs in 2009 alone.

While it is impossible to get any sort of accurate estimate on how many jobs would have been lost had the bill not been passed, most Americans (46% agree that the jobs bill did, at the very least, prevent an unemployment catastrophe in the US. (http://www.pollingreport.com/budget.htm)

A major push for the next job bill has yet to come, any sort of bill is likely to be attacked by conservatives who view the bill as more wasteful spending that will further the national debt and sink the economy in a deeper hole.

While many provisions in the original stimulus bill are controversial, it is clear that the American economy is still in dire need of another bill to stimulate job growth. Many Americans are still reeling from economic collapse and subsequent job losses, and are looking to point the finger somewhere. But as the numbers show, the stimulus bill is not the place for the blame to be directed.

Monday, March 8, 2010

Rasmussen Economic Indicators and Other News...

For the time being, here is some helpful polling from Rasmussen Reports that examines consumer confidence.

These general economic metrics are tied with the health of the job market. As consumer confidence increases, more people will begin to inject money into the economy, leading (in theory) to an increase in employment due to increased consumer demand. Rasmussen Reports notes that consumer confidence is up 26 points from this time last year.

In other news, job losses remained steady in February. This is good news considering most economists were worried that we would slip into another recession, a so called "aftershock" of what people are calling the "Great Recession", leading to increased job losses. Despite this, as the article mentioned, the U.S economy still lost 36,000 jobs in the month of February. Both Congress and the Obama Administration must now focus on job creation rather then simply minimizing job losses. Doing so is easier said then done, but the viability of the current administration lies on its ability to deliver in job creation.

These numbers represent a step in the right direction, but much more work needs to be done to get millions of Americans working again.

Tuesday, February 23, 2010

18 Million Jobs by 2012

The article, written by Robert Pollin, notes, "This can be done by combining two broad types of initiatives: measures to buttress the economy's floor and thereby prevent another 2008-type collapse, and measures to inject job-generating investments into the economy. If such initiatives are successful, the official unemployment rate will stand at around 4 percent when Obama runs for re-election in November 2012."

The article argues that 200 billion dollars is needed right now to create more jobs.

Here is a video from The Nation on their analysis:

The focus of this video is on the creation of green jobs. Here is one of Pollin's publications on the viability of green jobs.

Here is the full report from The Nation: 18 Million Jobs by 2012

We will be sure to analyze this huge report in a little bit more detail in upcoming posts/analysis.

Senate Moves Foward to Debate Jobs Bill

Republican Senators Scott Brown (MA), Susan Collins (ME), Olympia Snowe (ME), George F. Voinovich (OH) and Christopher Bond (MO) all voted for the measure, creating somewhat of a bipartisan coalition.

Senator Barbra Boxer of California noted, "Today, jobs triumphed over politics."

In addition to a payroll tax exemption, the bill extends tax breaks to small businesses that originated from the stimulus.

Is this the beginning of bipartisan action on jobs policy?

The short answer: no.

Even for a minuscule job creation bill that includes mostly tax cuts for small businesses only garnered five Republican votes. After this vote, conservative pundits/potential 2010 Republican candidates (Rush Limbaugh, Marco Rubio etc..) are likely to scold the Republicans who voted for the measure.

Wednesday, February 17, 2010

One Year After the Stimulus: Its Effect on the Job Market.

Today, the White House argued that the Stimulus created 2 million new jobs and kept the United Sates from falling into another depression.

Here is an video of President Obama discussing the impact of the stimulus in more detail:

Obama uses stories of small businesses that have been able to add jobs because of the Recovery Act in developing his argument. He also acknowledges that the current "recovery" doesn't feel like much of a recovery because unemployment still remains at 9.7%.

In a later segment, we will examine, in depth, where our money would be best utilized in creating new jobs.

Stay tuned!

Tuesday, February 16, 2010

Bipartisan Jobs Bill Scrapped

Source: http://www.time.com/time/politics/article/0,8599,1964397,00.html?xid=rss-topstories#ixzz0fjMV67p8

Additionally, Reid hopes to banish unrelated provisions from his new bills; the original jobs bill included disaster relief for several states and an extension of the Patriot Act. The unrelated provisions were considered by many to be essential in gaining the support of influential Republicans on the Senate Finance Committee.

Source: http://articles.latimes.com/2010/feb/11/business/la-fi-obama-economy12-2010feb12

Stay tuned for more info on jobs and commentary on Reid's efforts in the Senate!

Thursday, February 11, 2010

Tuesday, February 9, 2010

Obama open to 'incremental steps' on job growth

In the article , the President noted that he is confident "we should be able to come together" on a job-creation measure.

To boil things down, here are some of the proposals being debated in Washington right now:

1) President Obama would like to give 30 billion in TARP money to banks to boost small buisness lending as well as providing firms with a 5,000 dollar tax credit for each addition to their payroll.

2) A bill promoted by Charles Schumer (D - NY) and Orrin Hatch (R - Utah) would reward employers who hire a worker who has been unemployed for at least 60 days. They would be relivied of the social security payroll tax for that employee for the rest of 2010. Employers who keep that worker for more then a year would receive a 1,000 dollar tax credit in 2011.

3) A 85 billion dollar measure being considered in the Senate that would do three things a) extend a tax credit to employers who hire b) increase spending on infrastructure and c) extend unemployment benefits. Though unrelated to job creation, it is worth noting that this bill includes provisions to reauthorize the PATRIOT ACT. The wording for this provision can be found here, on page 125 section 645.

There are a lot of ideas being thrown around right now, and a lot of partisan divide. For the most part, Republicans would rather see more tax cuts, especially for small businesses, while Democrats support increased spending on infrastructure to promote job growth.

Stay tuned for our upcoming video, in which we will examine the most effective methods of jump starting job growth.

Friday, February 5, 2010

Reminder: The Recession Started with Bush

A Jobless Recovery? 20,000 Jobs lost in January

In what could be considered a small sliver of hope, the actual unemployment rate in the U.S decreased from 10% to 9.7%. Even though this decrease is miniscuel, and possibly due to discrepancies in data, it does indicate that unemployment is no longer rising.

The article also explores some of the specific policy proposals by the Obama administration, we will surley examine those specific aspects of any bill in the coming weeks.

Source: Economist

Finally, here is a interesting metric to follow in regards to the job market:

This Gallup feature should illustrate the extremely broad trends that are occuring in the job market today. It gives us a inside look at the dynamics of the employment trends through the perspecitve of an objectively polled employee.

Source: Gallup U.S. Job Market

Job Creation Nation's first video, featuring commentary by analyst Sunil Damle.

http://www.economist.com/world/united-states/displaystory.cfm?story_id=15409505

http://forecasts.org/unemploy.htm

http://www.bls.gov/news.release/empsit.nr0.htm