Monday, April 26, 2010

In this video The Real News Network correspondent Paul Jay interviews Robert Pollin, founding codirector of the Political Economy Research Institute at UMass Amherst, inquiring about the most efficient avenues that the Obama administration can take in creating jobs and strengthening the economy.

The video, titled Is War the Answer to Depression?, explores the efficiency of job creation in different markets in the United States compared to military spending. Pollin's studies have found that there are many other legitimate means of job creation, which operate more efficiently and effectively than the military. Pollin says "Using the input-output model from the Department of Commerce, what we basically find is as follows, that if you spend $1 million on the military, you create 12 jobs; if you spend $1 million on clean energy, you create 17 jobs; if you spend $1 million on health care, you create 20 jobs; if you spend $1 million on education, you create 29 jobs," making it clear that diversifying our investments in the job market would be wholly beneficial.

Pollin goes on to explain exactly why military spending is so much less effective than other industries. He notes that sending soldiers overseas ends up transferring taxpayer money into international economies more than our own. Pollin urges the government to bring jobs back from overseas to the homefront, stating that "obviously, military spending has a high proportion of spending abroad, and that's not going to create jobs in the US. These other areas that I mentioned—education, health care, clean energy—are much more focused on the domestic economy." If Pollins suggestions are realized, we could be looking at a much more sustainable, efficient, and morally sound economy.

Tuesday, April 20, 2010

Saturday, April 17, 2010

California Jobless rate hits new high; Unemployment Benefits Run Dry

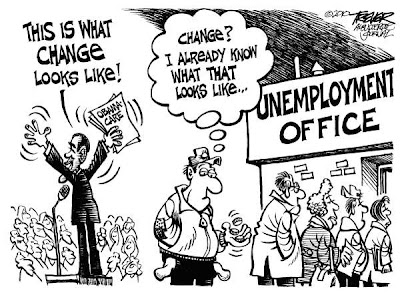

In March California, along with 24 other states, recorded new highs in unemployment rates despite speculation that the recession is ending, according to the United States Department of Labor.

Unfortunately, the Los Angeles Times' reports many Californian's, jobless benefits are expiring. It is estimated that as many as 100,000 unemployed Californians could loose their jobless benefits by mid-April.

Some economists blame California's job woes on the jobless benefits themselves, saying that they discourage people from seeking jobs, but this is very unlikely. Despite the recent passage of the Federal Jobless Bill, around 843,000 Californian's have been unemployed for at least 27 weeks. For every one job opening, there averages around 5.5 applicants, creating a very inhospitable job market.

With California's jobless rate hitting 12.6%, all levels of government are hard-pressed, while at the same time cash-strapped, to solve the recession's problems. In order to solve the unemployment problems, the government must pass solutions which precisely create jobs in order to stimulate the economy in the long term, as well as limit costs for the government, which could potentially be pushed onto the taxpayers and small businesses.

Unfortunately, the Los Angeles Times' reports many Californian's, jobless benefits are expiring. It is estimated that as many as 100,000 unemployed Californians could loose their jobless benefits by mid-April.

Some economists blame California's job woes on the jobless benefits themselves, saying that they discourage people from seeking jobs, but this is very unlikely. Despite the recent passage of the Federal Jobless Bill, around 843,000 Californian's have been unemployed for at least 27 weeks. For every one job opening, there averages around 5.5 applicants, creating a very inhospitable job market.

With California's jobless rate hitting 12.6%, all levels of government are hard-pressed, while at the same time cash-strapped, to solve the recession's problems. In order to solve the unemployment problems, the government must pass solutions which precisely create jobs in order to stimulate the economy in the long term, as well as limit costs for the government, which could potentially be pushed onto the taxpayers and small businesses.

Good Website to Follow the Job Market (Diffrences Between States)

Here is a good website which overviews the job market in the United States.

The website, odinjobs.com, presents a map of the United States on the left side of the homepage, examining the health of the job market in each state. States shaded in red have the highest demand for jobs while states in green have the lowest demand. Surprisingly, despite an 12.6% unemployment rate, California has an extremely high demand for jobs. Overall, California, Texas, Pennsylvania and New York have the most demand for jobs in the U.S. Wyoming, North and South Dakota, Montana, Idaho, West Virginia and Mississippi are lagging in relative demand. The map also presents data for median salaries. Once again, California and New York lead the nation, with the highest median salaries. The dynamics of the job market within individual states is an topic for further exploration. Some states are suffering from incredibly high unemployment rates while others are weathering the recession, not suffering from the same losses. This website is helpful in examining the differences in the job market between states.

Here is an article from NY Times which looks at statistics regarding the job market in individual states from March. It notes that 33 states showed job growth in March, with strongest growth coming from Maryland. States like California, Michigan and Georgia continued to hemorrhage jobs - evidence that the recession may be deepening in those states. Interestingly, North Dakota has the lowest unemployment at 4%. Once again, this article shows how the dynamics of job markets in individual states vary greatly.

Here is a video from New Mexico, highlighting the job market in New Mexico:

We will be sure to keep an eye on states individual unemployment rates as they will have political consequences in the 2010 and 2012 elections. Incumbents in states which continue to loose jobs may be punished by voters while the economy may be an non issue in states which continue to add jobs.

The website, odinjobs.com, presents a map of the United States on the left side of the homepage, examining the health of the job market in each state. States shaded in red have the highest demand for jobs while states in green have the lowest demand. Surprisingly, despite an 12.6% unemployment rate, California has an extremely high demand for jobs. Overall, California, Texas, Pennsylvania and New York have the most demand for jobs in the U.S. Wyoming, North and South Dakota, Montana, Idaho, West Virginia and Mississippi are lagging in relative demand. The map also presents data for median salaries. Once again, California and New York lead the nation, with the highest median salaries. The dynamics of the job market within individual states is an topic for further exploration. Some states are suffering from incredibly high unemployment rates while others are weathering the recession, not suffering from the same losses. This website is helpful in examining the differences in the job market between states.

Here is an article from NY Times which looks at statistics regarding the job market in individual states from March. It notes that 33 states showed job growth in March, with strongest growth coming from Maryland. States like California, Michigan and Georgia continued to hemorrhage jobs - evidence that the recession may be deepening in those states. Interestingly, North Dakota has the lowest unemployment at 4%. Once again, this article shows how the dynamics of job markets in individual states vary greatly.

Here is a video from New Mexico, highlighting the job market in New Mexico:

We will be sure to keep an eye on states individual unemployment rates as they will have political consequences in the 2010 and 2012 elections. Incumbents in states which continue to loose jobs may be punished by voters while the economy may be an non issue in states which continue to add jobs.

Tuesday, April 13, 2010

Friday, April 9, 2010

33 States SOL for Unemployment Benefits

33 states lack the capital to support jobless benefits, possibly the worst news since the recession hit. These states, including our own California, have borrowed massive amounts of money in order to fund benefits.

Money for jobless benefits are created when the government collects a small tax from employers on their employee's wages. CNN reporter Hibah Yousuf stated yesterday that "while total wages and weekly jobless benefit levels have been rising, governments haven't increased the taxable base wages at the same pace." This presents a bittersweet conclusion: unemployment benefits are rising (good); we don't have the money to pay for them (bad).

Yousuf writes that the government has caused this lack of money for benefits by using a "pay as you go" strategy. During strong economic times, the feds keep taxes and funds at a low level; during weak times (like right now), the government raises taxes and slashes benefits. It is no surprise that the mere 13 states who do have sufficient unemployment-designated funds did not use this strategy.

Andrew Stettner, deputy director of the National Employment Law Project, makes the obvious and necessary conclusion: "As the broke funds of 33 states makes clear, unemployment insurance reserves need to be stocked up before recessions hit so that states are prepared."

Stay positive, nation.

Money for jobless benefits are created when the government collects a small tax from employers on their employee's wages. CNN reporter Hibah Yousuf stated yesterday that "while total wages and weekly jobless benefit levels have been rising, governments haven't increased the taxable base wages at the same pace." This presents a bittersweet conclusion: unemployment benefits are rising (good); we don't have the money to pay for them (bad).

Yousuf writes that the government has caused this lack of money for benefits by using a "pay as you go" strategy. During strong economic times, the feds keep taxes and funds at a low level; during weak times (like right now), the government raises taxes and slashes benefits. It is no surprise that the mere 13 states who do have sufficient unemployment-designated funds did not use this strategy.

Andrew Stettner, deputy director of the National Employment Law Project, makes the obvious and necessary conclusion: "As the broke funds of 33 states makes clear, unemployment insurance reserves need to be stocked up before recessions hit so that states are prepared."

Stay positive, nation.

Friday, April 2, 2010

Interview with Economics Professor Sita Slavov

The following post is an interview with Prof. Sita Slavov.

Sita Slavov teaches Principles of Economics II, Intermediate Microeconomics, Economics of the Public Sector, Econometrics, Game Theory, Economics of Information, and a Core seminar at Occidental College. According to her bio on the Economics Faculty page of the Oxy website, "Her research interests include the political economy of intergenerational transfers and the design of Social Security. One of her current research projects examines the risk associated with privatizing Social Security compared to the risk present in the current pay-as-you-go system." She has written over a dozen published articles and working papers and served as a senior economist for the White House Council of Ecocomic Advisers from Aug.2007-June 2008.

Are you familiar with the recently passed HIRE Act? Do you think it will be effective?

It's hard to say how effective it will be. In general, temporarilycutting the payroll tax for *all* workers is a good fiscal stimulus

policy. It encourages firms to hire and, compared to other kinds of

tax cuts, puts more money in the pockets of low-income individuals.

It's certainly better than large amounts of federal spending without

careful cost-benefit analysis (like a lot of the ARRA spending). But

I question the value of additional stimulus at this point. The

economy has started to recover, so to a certain extent, the credit

will go to firms who would have hired people anyway. That is wasted

money. Also, the HIRE act doesn't cut payroll taxes for everyone --

only for workers who have been unemployed for two months -- and this

can create problems. Ideally, an employer should hire the best

candidate for a job. Tax considerations should not influence this

decision. But the best candidate for a job may not be someone who has

been unemployed for 2 months. So, a firm may hire someone who is not

as productive just to take advangate of the credit.

What would you propose, if you were a legislator, to boost the job market?

to work and focus on policies that strengthen the job market in the

long run. Taxes on income discourage work, and highly progressive

taxes discourage education (because the resulting higher incomes are

taxed more heavily). Federal taxes are highly progressive -- the top

20% of households pay more than two thirds of all federal taxes

combined. Taxes should be made lower and flatter. Lowering the tax

burden on investment can also increase investment and boost

productivity and wages.

What can the American public do that you think is important? What about business owners?

The American public can lower its expectations of government. Thesame goes for business owners. The government is facing serious

long-run budget problems. Still, we want the government to fix the

economy, subsidize our car and home purchases, pay for our health

care, make us feel safe -- and not raise our taxes. But the reality

is that if we want all these "goodies" from the government, we have to

be willing to pay for them -- we can't just shift the entire bill onto

the few people who make more than $250,000 a year. Larger welfare

states and safety nets in Europe are paid for by higher taxes on

everyone, not just the super rich. We need to do a better job of

recognizing this basic tradeoff and stop expecting the government to

give us everything want.

Is there any way to increase job security so that this spike in unemployment would happen again?

will experience high unemployment again. There is very little the

President or Congress can do to prevent recessions. The goal for

policymakers should be to try to manage business cycles as well as

possible. They can try to reduce the severity of recessions through

monetary and fiscal policy, and provide a safety net (e.g.,

unemployment insurance) for those who are hit the hardest. Also, a

well-functioning labor market with minimal regulation can adjust more

quickly to changing conditions.

Subscribe to:

Comments (Atom)